Paretotopian Goal Alignment

Prospects for greatly expanded resources can reduce incentives for greed and conflict, even when dividing those resources is a zero-sum game.

From tribes to states, competition for limited resources has driven conflict, and while resource competition is only one cause of conflict, it remains a powerful force.1 Within a fixed-resource framework, interests appear to be directly opposed, because dividing fixed resources is a zero-sum game. If we take this zero-sum game as a model of the future, incentives for cooperation seem sharply limited.

The concept of “Paretotopian goal alignment” shows how prospects for AI-enabled capabilities could reshape incentives — provided that these prospects and their implications are understood in advance. This article illustrates how prospects for greatly expanded resources could blunt incentives for conflict and help align the goals of competing actors towards mutually beneficial outcomes.

The Zero-Sum Game of Fixed Resources

The division of fixed resources is often viewed as a zero-sum game: For one party to gain resources, another must lose. Within the scope of a resource-centered framework,2 a zero-sum constraint creates directly opposed interests among competing actors, whether individuals, corporations, or nation-states:

In this model, the total resource quantity (Q) is fixed (QA + QB = Q = 1). Thus, any gain for Actor A necessarily means an equal loss for Actor B. However, when dealing with large quantities of resources, it is often more appropriate to consider utility on a logarithmic scale due to the principle of diminishing marginal returns.

For example, under logarithmic utility, an increase in total monetary holdings3 from $100,000 to $200,000 is considered equivalent in value to an increase from $100,000,000 to $200,000,000. This contrasts with a linear model, which would treat the greater as vastly more significant.

Considering utility rather than resources (and situations other than small steps around equal division), losses for one actor may exceed gains for the other, yet interests remain directly opposed:

The Impact of Resource Expansion

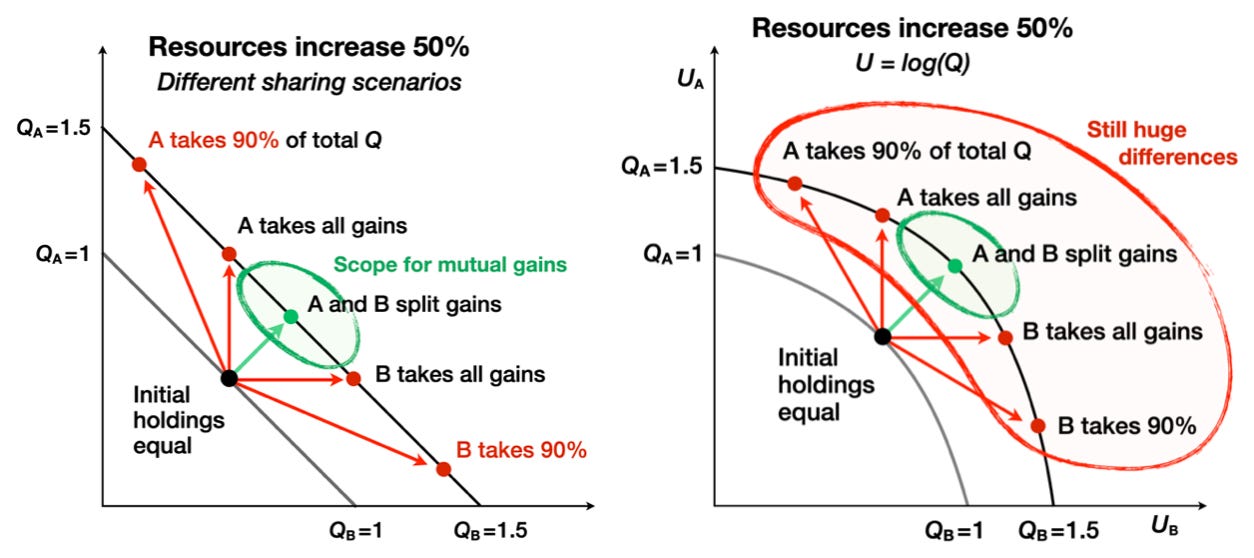

Now, let’s consider what happens when the total amount of available resources increases. Even a moderate increase, say 50%, begins to change the nature of the game:

This expansion opens a range of Pareto-preferred moves4 — outcomes in which both parties can gain simultaneously. In our resource expansion scenario, there’s now room for both Actor A and Actor B to increase their holdings.

However, at this level of expansion (moderate, yet large by the standards of short-term economic growth), there remain strong incentives for each party to seek a disproportionate share of the resources. One actor might secure large gains at the expense of the other by capturing all the gains, or by taking 90% of the total resources. Gains and losses from such “greedy” strategies would motivate conflict, and the arrows in the diagram above are far from aligned.

When we consider utility rather than raw quantity, the incentives for greedy behavior are still substantial. With logarithmic utility, the difference between taking 50% and 90% of the resources is somewhat less dramatic than in a linear model, yet remains a strong incentive for aggressive greed.

Resource Expansion and Changing Incentives

The game changes dramatically with the prospect of massive resource expansion, for example, an increase by a factor of 1000. This scenario fundamentally alters the incentive landscape:

As this diagram suggests, the prospect of 1000-fold expansion reduces incentives for greedy behavior because the difference in perceived value between gaining 50% or 90% of the total resources — as seen from the initial position5 — becomes relatively small. Securing a substantial share of prospective gains becomes more important than the incremental value of securing a larger share of the total.

This shift in incentives creates a larger space for mutually beneficial outcomes, reducing concerns over competing notions of fairness.

This rapid-expansion scenario differs from historical patterns of economic growth. While global economic growth has typically hovered around 3.5% per annum, the prospect of multiple-order-of-magnitude increases within a future decision-making time horizon is novel.

Conflict Risk and Goal Alignment

Risks of conflict further reinforce the alignment of goals: Actions aimed at securing large (yet low-value) unilateral gains risk opposition, conflict, and losses. Conversely, actions directed toward outcomes perceived as reasonably fair are more likely to gain support and succeed.

When we factor in the potential costs of conflict, the expected value of pursuing large, unilateral gains decreases significantly. The potential losses from conflict (for example, global destruction) could easily outweigh the marginal gains from securing a grossly disproportionate share of the new resources.

Additional Factors Affecting Goal Alignment

Several other factors contribute to goal alignment in scenarios of great resource expansion:

Satiation of resource demand: Some desires are inherently satiable, leading to a more rapid decline in the marginal utility of additional gains.

Non-rivalrous goods: The increasing importance of non-rivalrous information goods and services further reduces incentives for conflict over resources.

Positional goods: While value placed on relative status can limit goal alignment, a vast increase in absolute resources can mitigate this effect to some degree; for example, continued disproportionate wealth ratios become compatible with universally high standards of living. However, the value placed on power over others remains problematic and relates to broader security concerns among unequal actors.

Security concerns: While a deep exploration of fundamental security issues is beyond the scope of this article, the conclusion is important: Defensive stability can be established despite asymmetric resource distribution. In situations within the realm of economic and technological possibility, resources held by one actor need not threaten the security of another. This topic warrants further investigation as it’s central to the potential realization of Paretotopian outcomes.

The Concept of Paretotopian Outcomes

The potential mitigation of zero-sum incentives in resource competition supports the broader concept of “Paretotopian outcomes” — accessible futures that would be strongly preferred by a wide range of actors today. These are outcomes where (almost) everyone is better off, and (almost) no one is worse off, compared to the current state.6

Understanding prospects for Paretotopian outcomes could influence policy decisions and strategic planning. Changes in perceived options can change perceived interests, potentially motivating a deep reconsideration of policies.

Conclusion

The concept of Paretotopian goal alignment offers a framework for understanding how greatly expanded resources could change incentive structures, opening new possibilities for cooperation and mutual benefit, even among traditionally competing actors.

This perspective invites a reconsideration of approaches to resource allocation, conflict resolution, and long-term planning, with potential implications for global policy and governance. It suggests that strategies aimed at dramatically expanding collective resources and capabilities could mitigate many zero-sum conflicts and shift the focus towards cooperative strategies for risk management.

War has shaped humanity, and its prototype — tribal warfare — was driven by an existential, zero-sum competition for the resources that land can provide. Over the millennia, the causes of conflict have gained substantial autonomy from their roots, yet beneath the layers of religion, ethnicity, grievance, and security threats is a long-term, resource-centric, us-or-them driving force. Even if the driving force of resource competition were to vanish completely, its effects would persist indefinitely.

A resource-centered framework can capture only one facet of a complex reality, even if we were to count, for example, attention or market share as resources.

Here, money represents resources, whether or not those resources can be purchased.

A Pareto-preferred outcome is one in which at least one party is better off, and no one is worse off.

Consider two scenarios from the perspective of a decision-maker who receives resources worth $100,000 per year for personal consumption:

Scenario A: Either continue to receive $100,000, or increase to $200,000.

Scenario B: Increase resources for personal consumption to either $100 million or $200 million.

Both scenarios present a twofold difference in personal wealth. A logarithmic utility model, U = log(Q), would assign equal utility differences (ΔU) to these outcomes, regardless of the decision-maker’s current wealth. However, most people would be far more motivated to double their current wealth (Scenario A), than to double a life-changing windfall (Scenario B).

This difference between model predictions and realistic preferences reveals the limitations of context-independent utility functions, particularly across vast wealth scales. It implies that the perceived relative value of potential outcomes, ΔU, depends on the situation from which the two scenarios are viewed.

It is important to the argument made here that decision-makers confront what is in effect a single-step decision regarding outcomes that result a large expansion in total resources. Perspective matters, and a series of incremental decisions is not the same as a single decision involving transformative change.

This does not address problems stemming from the deep disruptions of human affairs that seem inevitable in all scenarios of great technological capability. Whether any realistic future, taken as a whole, is preferable to the past or present is in practice a moot point, and the implications of expanded resources for goal alignment remain.